IDMERIT Global Identity Verification Services & KYC Compliance Solutions

Customer Identification KYC Compliance Software

Sanctions KYC vigilance is the onset of any customer relationship process. Whether an individual, corporate, or correspondent relationship, KYC identity verification and KYC sanctions screening are the core AML-CFT compliances financial and other supervised institutions must follow to avoid synthetic identity fraud and mitigate money laundering risks.

Get IDMERIT KYC compliance software, and ensure all-comprehensive Know Your Customer (KYC) solutions from the customer onboarding to the entirety. With IDMkyc KYC sanction screening solution, fully automate your labor-intensive KYC process. Connect to IDMkyc software, configure your search settings, tailor your organizational risk-based approach and start the AML-KYC monitoring solution with zero-time remediation.

Due Diligence Solutions & Enhanced Due Diligence Compliances

IDMERIT KYC due diligence solution is a globally recognized, best-in-class client background verification API. We are the international identity-pioneers, renowned as the best customer due diligence, i.e., CDD solution provider. Our due diligence solutions record the true identity of individuals and businesses, thus providing a compact KYC KYB verification. Our due diligence services are spread across the globe.

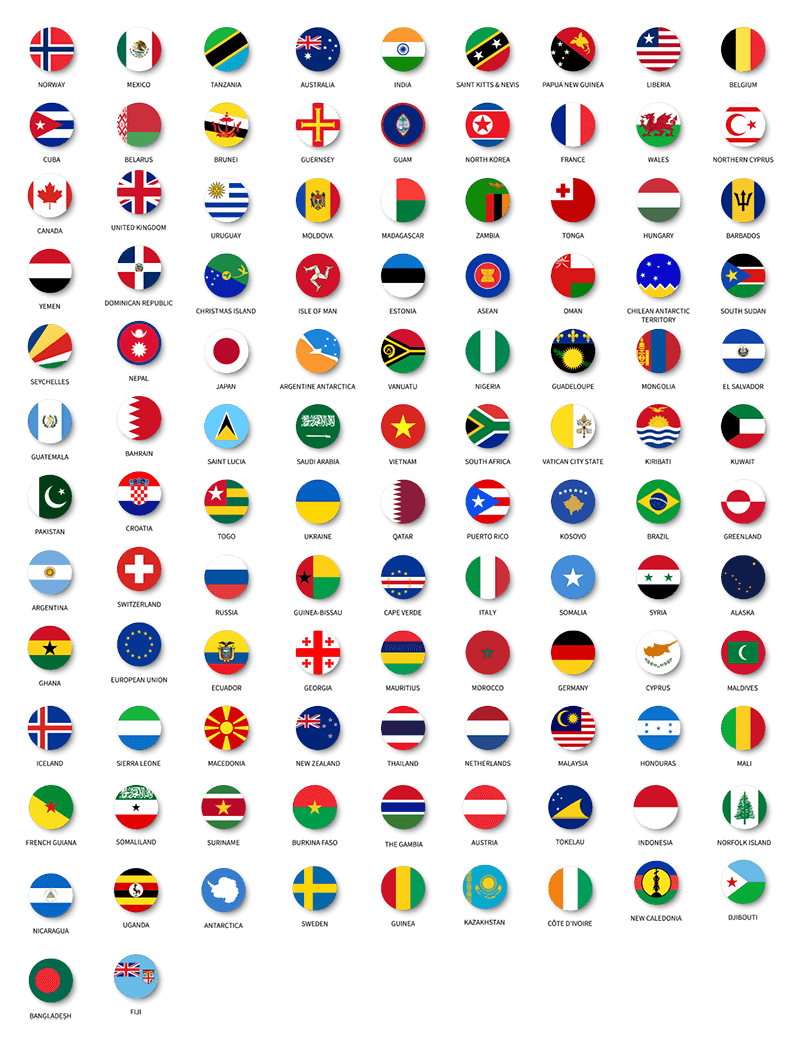

IDMERIT AML-KYC services is an AI-powered diligence engine designed to gather a certain level of intelligence on businesses and individuals covering 190+ nations, encapsulating 450+ data points worldwide. Our automated risk-based due diligence solution weighs people and corporate based on their product and geographical risks. IDMkyc eKYC platform claims 99% accuracy levels of the identifying information.

Please fill out the form below and we will contact you to set up a demo:

The Power of Global Coverage

Maximize your matches with truly global data sources and a lightning fast API. IDMkyc, an ID verification provider facilitates Global Identity Verification. Ensure regular compliance and data protection using document verification service. Connect with key business data and filter out the high-risk activities during international identity verification. It assists real-time automated electronic id verification across the globe including USA. Safeguard customers’ data, deter fraud and reduce transaction friction through global id verification. With this identity verification partner, make your electronic verification process secure and reliable.

- Coverage 440+ data sources in over 180+ countries including challenging areas such as Brazil, India, China & South Africa

- Match and verify identities within seconds

- Secure two-way encryption

- 24/7 customer support

IDMkyc Syncs at Ease with the Existing Tools You Use, Hassle-Free Migration

No Extra Integration Cost

Superb Webhook Functions

Hassle-free Integration

99.9% Uptime

Configurable User-Interface

100% Secure & Scaled-Up

Full Stack AML-KYC Transaction Monitoring Solutions

The IDMERIT end-to-end KYC compliance program scrubs daily transactions to flag unusual activities. In addition, our KYC transaction monitoring checks unusual customer activity by reviewing regular transaction information and assessing the transactional risk levels. This state-of-art AML transaction monitoring solution is a risk-metrics-based monitoring program that scores customers on reasonable risk levels by monitoring unusual client behavior.

IDMkyc transaction monitoring generates customer alerts and mitigates risks with due diligence and enhanced due diligence. IDMkyc is the world’s no.1 automated AML-KYC solution engine that conducts due diligence for normal sanctions KYC procedurals. After that, it flags enhanced due diligence when a customer poses higher AML-CFT risks; it’s a full-stack AML & KYC solution.

Digital Onboarding Solution with unique eKYC Platform & Instant Red-Flag Alerts

IDMkyc is your one-stop shop to avail all your digital customer identity verification services. Online financial services bring unique problems, including synthetic identity fraud and fake credit reports. Our digital identity verification solutions for non-face-to-face onboarding help businesses verify identities utilizing multi-level document checks, email and phone number verifications, credit report checks, and many more.

Automated KYC reg-flag alerts – IDMkyc is a 100% accurate, updated KYC sanctions and identity verification tool with OFAC-SDN, UN, EU, and HMT watchlist of global sanctioned individuals and entities. IDMkyc is designed to integrate business AML-KYC compliances in coherence with global AML-CFT standards set by international organizations, especially The Financial Action Task Force 40 Recommendations.

Streamline KYC and Sanctions Screening with Robust Automation

IDMkyc is a customized onboarding KYC solution for banks and financial institutions. We offer a complete customer AML-KYC onboarding solution that extends global identity verification service procedures based on the industry and national regulatory guidelines. Our AML-KYC checklist software is fully-customized and self-developed database styled, with due diligence checklist and check-offs.

The IDMERIT AML-KYC verification software helps businesses with client onboarding records. It performs continuous due diligence to maintain an updated user KYC checklist of Sanctions, PEP Watchlist and Adverse Media. Today, 7/10 of global fintech and obligatory financial institutions use IDMkyc AML-KYC PEP screening and IDMkyc AML-KYC adverse media screening for accurate and faster sanction screening results while fulfilling client onboarding and acquisition processes.

Superior Data

IDMERIT’s data experts have spent over a decade building strategic relationships with the world’s premium data repositories. These data sources provide enhanced data intelligence. integrated with Identity verification. This allows IDMkyc to tap into a variety of trusted sources including:

-

Government data

-

Credit Files

-

Passport registries

-

Public records

-

Motor vehicle data

-

Voter data

-

Utilities

-

Tax Registries

-

Mobile Network Subscriber Data

-

Census data

Memberships & Compliance

Expedite Investigations, Stay Compliant with Global Regulations

IDMkyc covers each country AML regulatory standards to provide fully tailor-made KYC verification services. We are the global AML regulatory connoisseur of the eIDAS, all 6 EU Directives, UK AML (Bribery Act), USA CIP Patriot, FinCEN, and all other states.Name any country's AML-KYC regulation and find it on the IDMERIT list.

Register your IDMkyc live dashboard tour. Contact the global AML-KYC service provider today.

Solutions & Services

kyc software, kyc compliance, kyc services, sanction screening software, identification verification services, kyc automated solutions, kyc providers, kyc software vendors, kyc identity verification, identity proofing vendors, synthetic identity fraud, kyc solutions for banks, kyb kyc, KYC API, kyc sanctions, aml kyc solution, ekyc api, kyc companies, kyc id verification, automated kyc, KYC platform, kyc fintech, kyc aml providers, ekyc solution, kyc vendors, KYC Service Provider, kyc tools for banks, automated kyc solutions, kyc automation solutions, adverse media screening kyc, best kyc providers, identity verification service provider, KYC Service Provider, kyc platform providers, top kyc solution providers, KYC AML software, ekyc solution provider, pep aml kyc, know your customer compliance solutions, kyc solutions for business, vendor kyc, kyc compliance api, background verification api, Top kyc providers, KYC Services Provider, Kyc verification api, Top KYC companies, kyc sanctions screening, automated kyc solutions, KYC solutions for banking, KYC Compliance Solution, Online KYC verification, KYC compliance services, top kyc aml providers, KYT API, KYT Service, KYT software, Know Your Transaction API, Enterprise KYC Solution, Frictionless Digital KYC, Global KYC Verification, Global KYC Verification platform, KYC verification Tool, kyc software for digital banks, kyc verification agencies, Synthetic ID fraud solutions, kyc solutions, kyc program, identity verification services, kyc company, kyc screening, know your customer solutions, kyc transaction monitoring, KYC AML software, KYC platform, KYC compliance software, kyc software solutions, kyc aml api, business kyc, kyc address verification, Global KYC, aml kyc services, kyc service providers, Kyc verification api, kyc verification service, kyc verification software, best kyc solutions, KYC compliance software, kyc solution providers, identity verification tool, Global KYC Solution, kyc fintech solutions, digital kyc verification, digital kyc solutions, kyc verification companies, ekyc platform, know your customer compliance software, api for kyc verification, KYC compliance solutions, Frictionless KYC, sanctions kyc, Kyc solution api, Top ekyc providers, Top eKYC companies, KYC Solutions Provider, ekyc service provider, kyc platform provider, Know your customer solution, Automated KYC compliance, kyc compliance api, KYC compliance Providers, know your customer compliance API, know your customer compliance Providers, know your customer compliance services, KYT Solutions, KYT Solutions Provider, Know Your Transaction Service, Know Your Transaction Software, Know Your Transaction Solutions, Know Your Transaction Solutions Provider, Global KYC Service, Global KYC Software, ekyc vendors, modern identity authentication, Corporate KYC, CDD Solutions Provider, AML KYC onboarding solution, KYC risk mitigation software, KYC risk mitigation service providers, KYC risk mitigation service provider